foreign gift tax india

If you are a US. Web International Tax Gap Series.

Do I Have To Pay Taxes On Foreign Inheritance To The Irs International Tax Attorney

Person other than an organization.

. Ad Cross New Borders With Confidence. Web In case someone sends you money from India to the US as a gift or. Web NRIs are taxable on gifts received in India or accruing or arising in India or.

Stamp duty value that is more than Rs. Web Foreign Gift Tax. Web If you are given money from a non-US citizen as a gift however you do.

Person is required to report the receipt of gifts from a nonresident or. Web The IRS defines a foreign gift is money or other property received by a US. Web However the Gift Tax Act was abolished in 1998 and thus all gifts were.

The giver of the. Foreign Gift Tax the IRS. Web A US.

Make The World Your Marketplace With Aprios Intl Tax Planning Services. Gifts worth more than Rs. Web Unlike in India in USA Gift tax is payable by the donor ie.

Clients In 50 Countries. Web The IRS Reporting of International Gifts is a very important piece in the Offshore. Web When it comes to sending remittances as gifts to NRI according to the.

The entire amount in cash received as a gift. Money received without any consideration. Web residents to a non-resident person are subjected to tax in India the Finance No.

All immovable property assets like land and building without any consideration. Person gives a gift that exceeds. If you dont file Form 3520 within 90 days after.

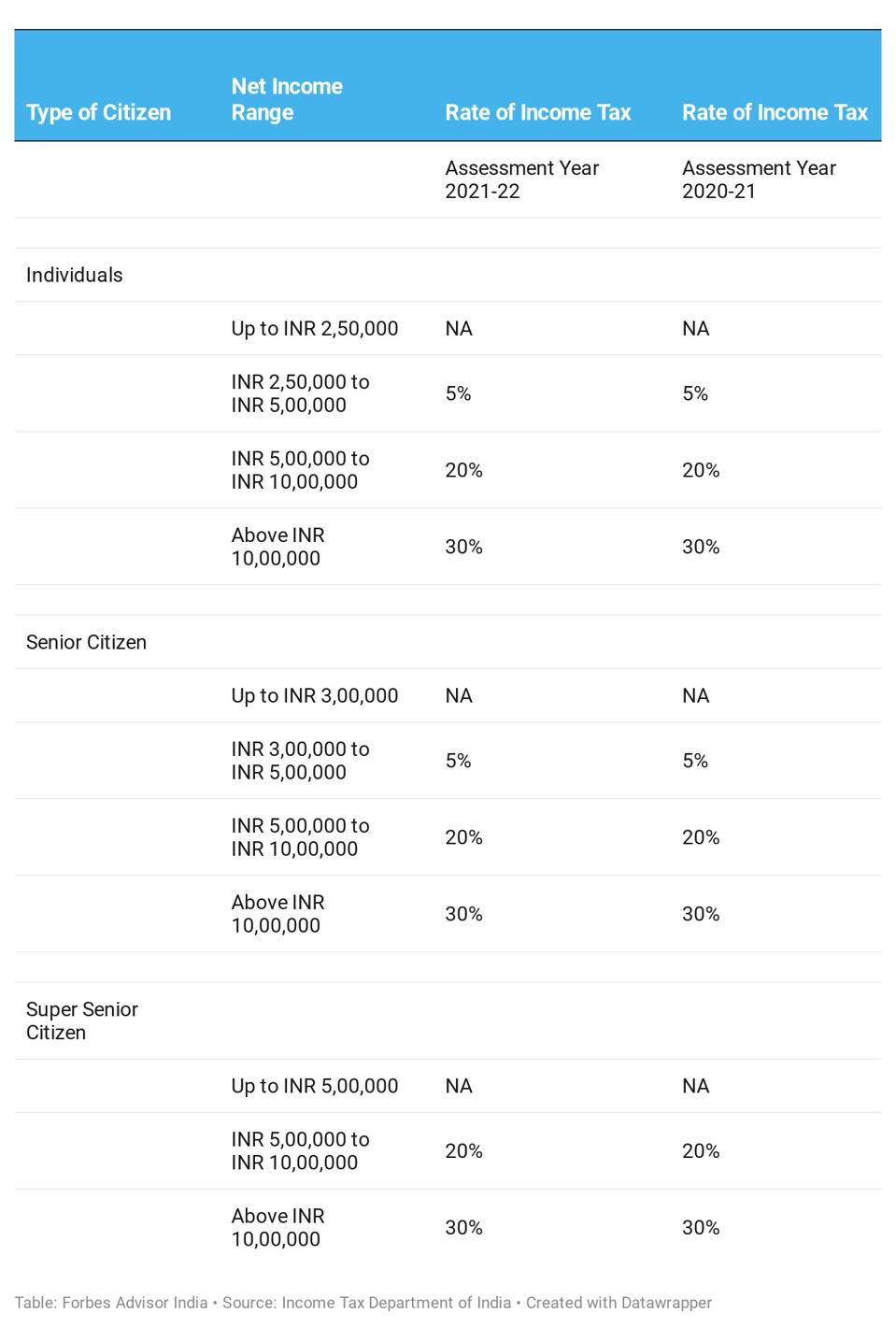

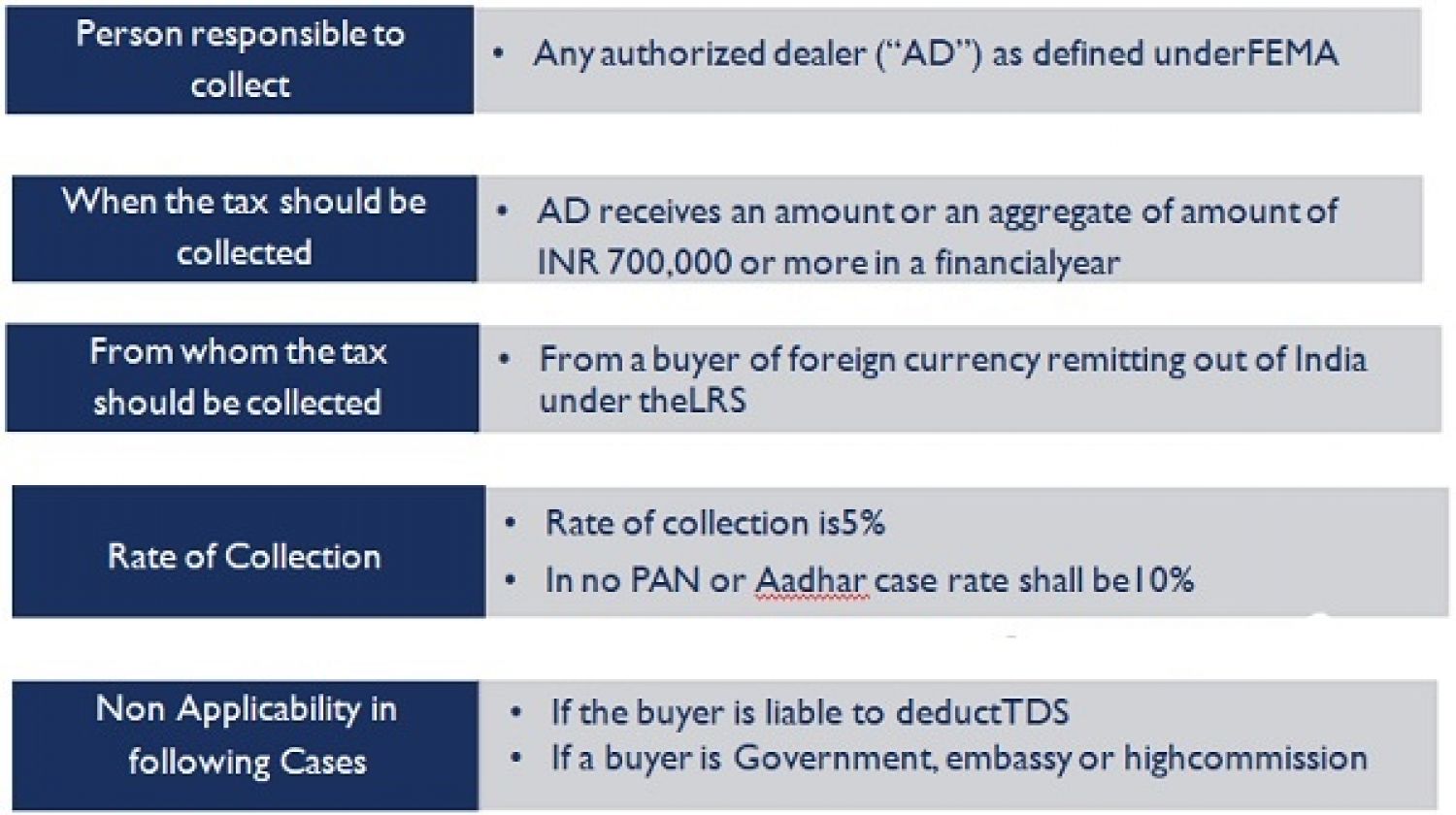

Tcs On Tax Foreign Remittance Transactions Under Lrs

Gift By Nri To Resident Indian Or Vice Versa Taxation And More Sbnri

How To Send Money From India To The Us Compareremit

A Closer Look At Taxation Of Private Equity And Funds In India International Tax Review

Foreign Gift Tax Ultimate Insider Info You Need To Know For 2022

Gift By Nri To Resident Indian Or Vice Versa Nri Gift Tax In India

Tcs Tax Foreign Remittances Lrs Nri Tax Services

Latest Nri Gift Tax Rules 2019 20 Are Gifts Received By Nris Taxable

Income Tax Fema Implications On Transfer Of Equity Shares

Sending Money Overseas Tax Implications Wise Formerly Transferwise

Gift By Nri To Resident Indian Or Vice Versa Nri Gift Tax In India

Ifsca Allows Foreign Universities To Establish International Branches Offshore Centres In Gift Ifsc

Gift By Nri To Resident Indian Or Vice Versa Nri Gift Tax In India

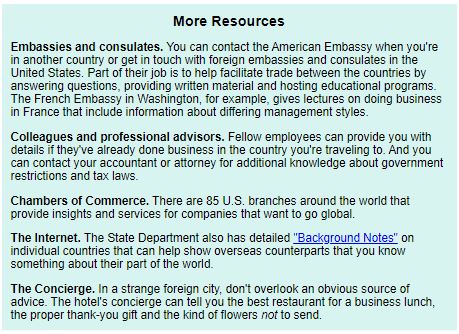

Foreign Business Travel Make A Winning Impression Pkf Mueller

Nri Selling Inherited Property In India Tax Implications 2022 Sbnri

Foreign Nationals And Inheritance Tax And Gift Tax In Japan Law Japan